With MGR you can set up global tax, tax percentage and the option to include it in prices while creating your shop’s profile. This will free you from the need to manually set up tax classes for repair parts, sales, accessories etc.

The way you set taxes up in MGR depends on whether your in-store prices are displayed as tax inclusive or exclusive.

Note: If your store is in the USA or Canada then your prices would be tax-exclusive whereas, in Australia, UK and New Zealand, tax-inclusive prices are applicable.

To set up global tax for your new store:

Steps:

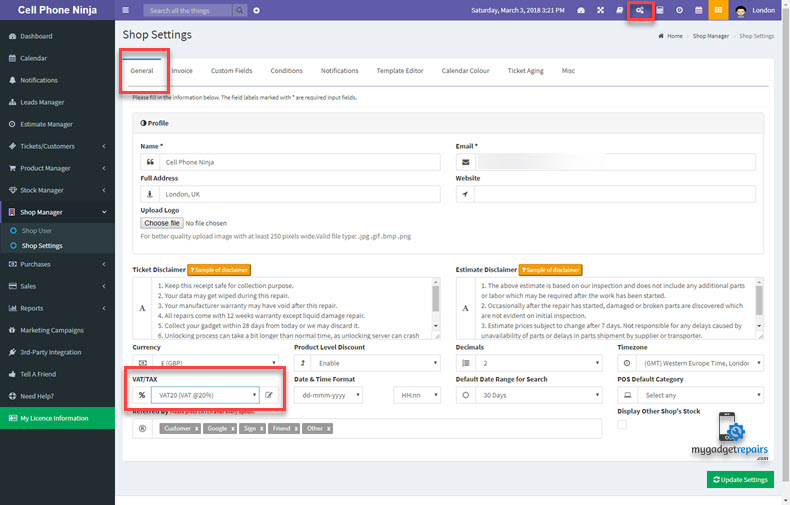

1. Log into your MGR account via a web browser.

2. Go to Settings by clicking on the gear icon and go to General Tab.

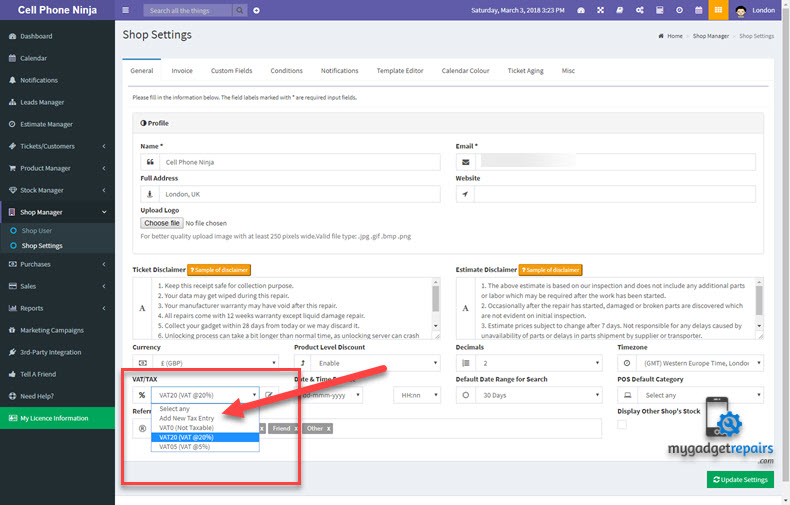

3. Go to VAT/TAX field and click on the drop-down menu.

4. Select appropriate percent of the tax, we have created 3 tax rates for you, VAT0 (no VAT/Tax), VAT5 (5% tax) and VAT20 (20% tax).

5. Finally, click on Update Changes button at the bottom.

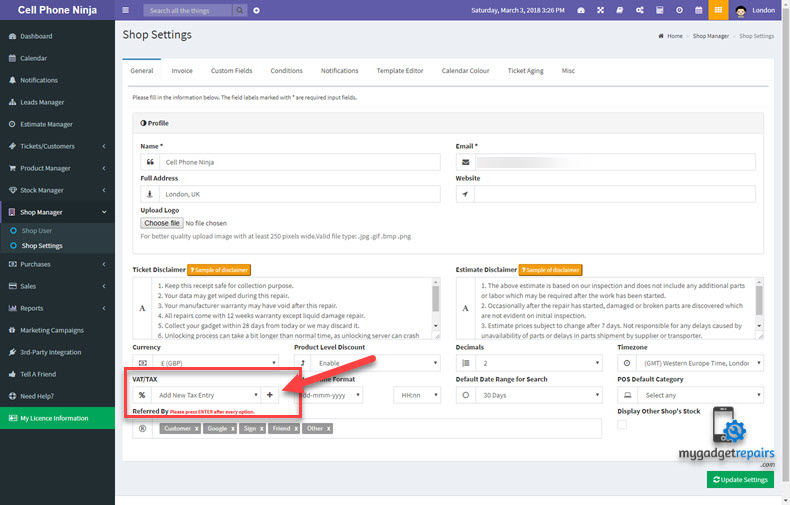

If you need to add a new tax rate then select “Add New Tax Entry“, then click on the + icon and follow the process.

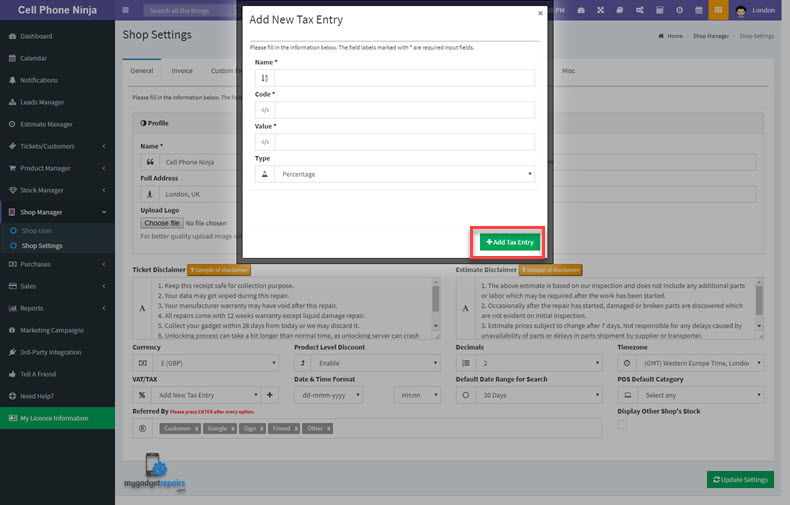

Fill up the form with appropriate values then click on “Add Tax Entry” to finish the process.