We’re always on the lookout for ways that we can add value to users of MGR and today we’re happy to announce our new module called “VAT Margin Scheme”. Click here if you want to read more about the scheme and if it applies to your business.

The VAT Margin scheme is designed to be used by VAT registered businesses that buy and sell secondhand goods, works of art, antiques and collector’s items. It allows the seller of such goods, under certain circumstances, to pay VAT to HMRC only on the difference between the price he bought them for and the price he sold them for.

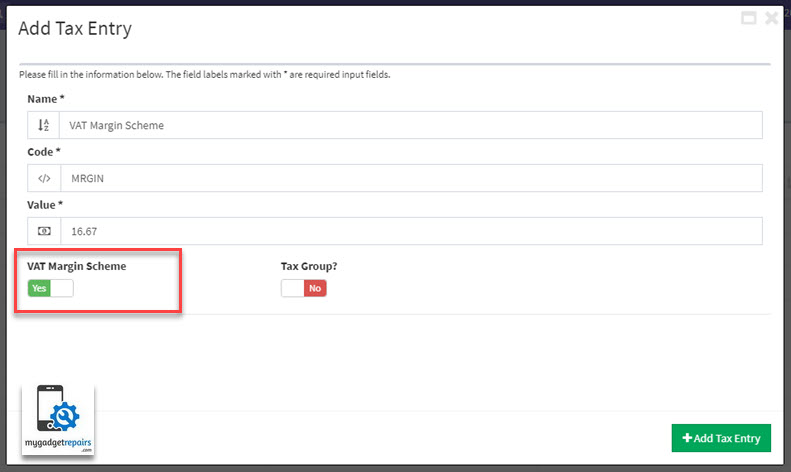

To set up VAT Margin Scheme, first of all, you need to create a tax rate with “VAT Margin Scheme” so please head to Settings > Misc > Ticket > Manage Tax Entries.

Create a new tax and please make sure that you have enabled “VAT Margin Scheme” as shown in the picture below.

Once the tax rate is created please use this rax rate on any products which are applicable for “VAT Margin Scheme”.

There are following conditions applies on the product page.

- If product type is “Service” then you will not see the tax rate with margin scheme enabled.

- If the product condition is “New” then you can’t select the vat with the margin scheme enabled as its ONLY applicable on second-hand items.

On the following interfaces, VAT will be calculated based on the “VAT Margin Scheme”.

- Ticket Interface

- POS Interface including hold orders

- Recurring Invoices

- Estimate Interface

- All the Reports

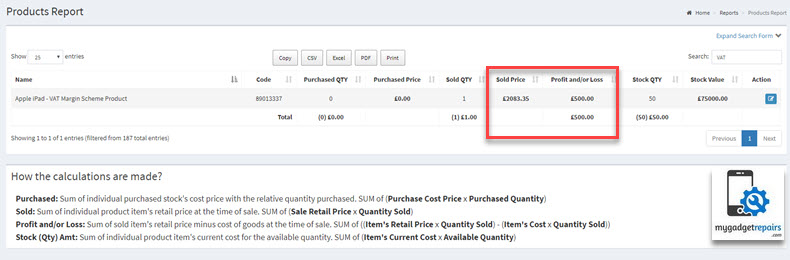

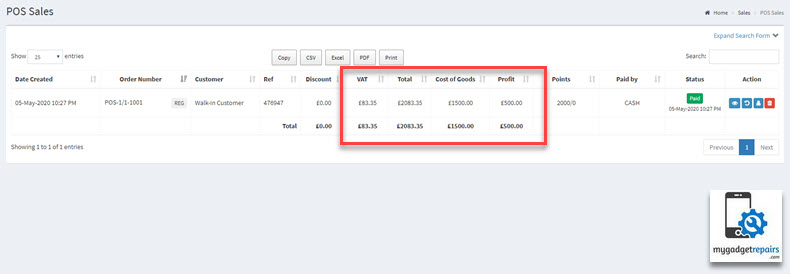

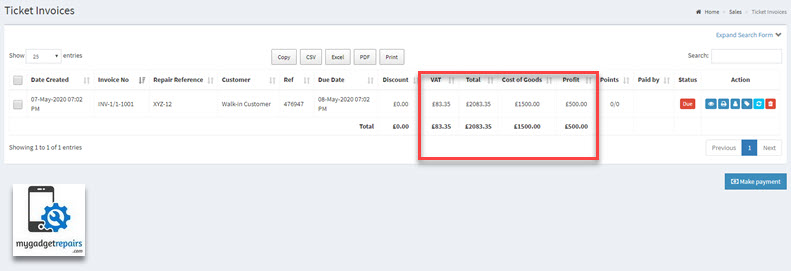

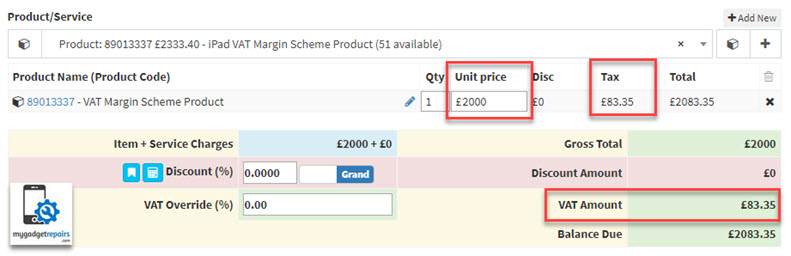

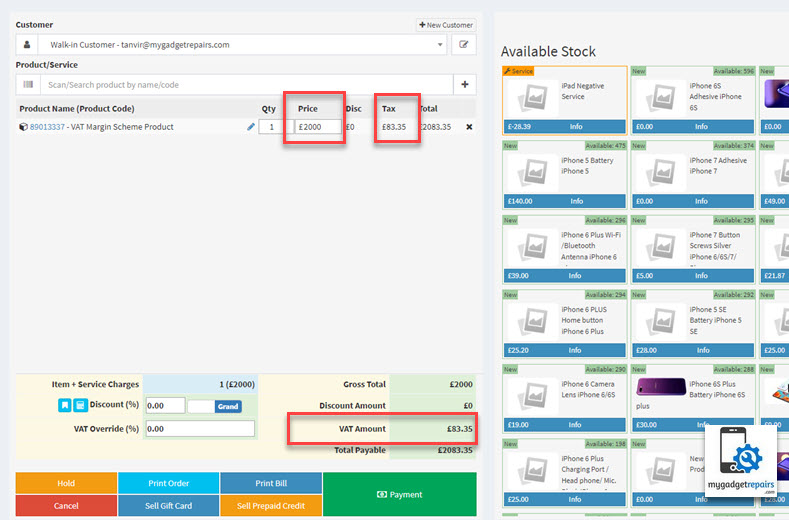

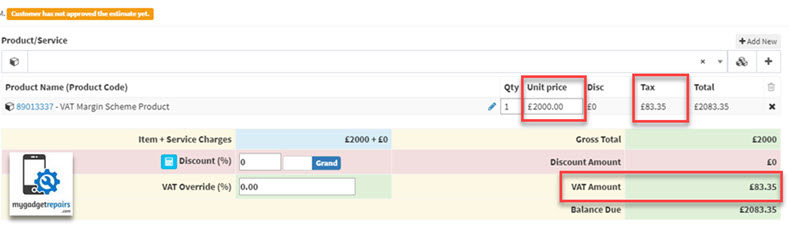

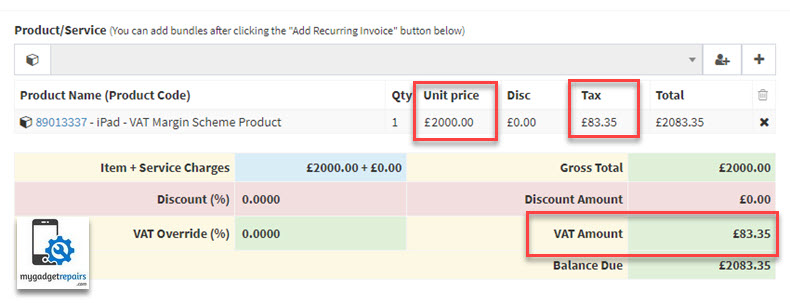

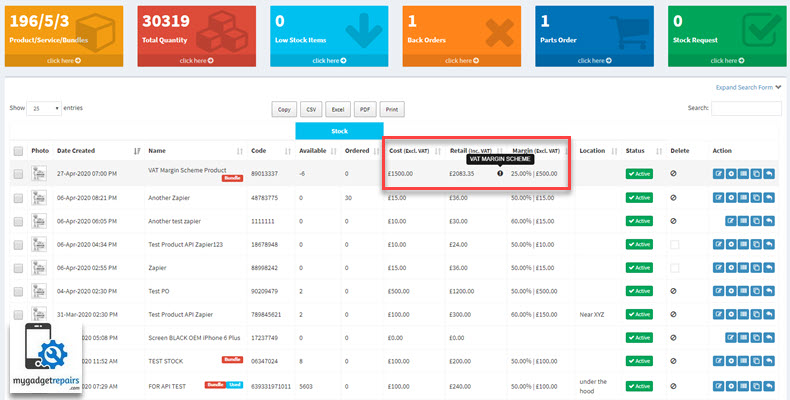

In the following example, I have created a product, the cost price is £1500 and the retail price is £2000, the VAT has “VAT Margin Scheme” enabled. As you can from the following screenshots that the system has calculated 16.67% vat which is £83.3 based on my profit (£1500 – £2000 = £500) rather than on £2000.

Ticket Interface

POS Interface

Estimate Interface

Recurring Invoices Interface

Product Interface

Reports