Governments throughout the world require some sort of registration for your business. It’s often one of the pre-requisites for allowing you to operate under rules and regulations dictated by law. Not only does it allow governments to regulate businesses but it also offers you many advantages such as tax benefits and cuts.

MGR allows you to enter your Business Registration Number or Tax Identification Numbers such as ABN(Australian Business Number), ACN (Australian Company Number) or VAT (Value Added Tax Identification Number). This will enable you to mention these registration numbers on tax invoices, customer receipts and paid invoices.

A brief description of these registration numbers are as following:

ABN (Australian Business Number) – An ABN is an 11 digit identification number that identifies your business to Australian Government and Public Community. Though not a replacement of Tax ID, it serves many business and legal purposes.

With an ABN you can:

– Identify your business to other while issuing orders to invoicing.

– Avoid PAYG (Pay As You Go) tax on receiving payments.

– Claim GST (Goods & Services) credits.

– Obtain an Australian domain for your website.

– Claim credits for energy grants.

ACN (Australian Company Number) – ACN is a 9 digit code issued by ASIC or Australian Securities and Investment Commission to identify your business. It is mandatory to mention this ID on all invoices issued by your company if it is operating in Australia.

ABR (Australian Business Register) – The ABR enables you to business-to-government and government-to-business processes, for example, Tax Office transactions involving the collection and remittance of the Goods and Services Tax (GST).

VATIN (Value Added Tax Identification Number) – It is a registration number used in many countries, most of the members of the European Union.

With VATIN you can:

– Improve your business profile.

– Facilitate business dealings.

– Avoid financial penalties.

– Claim VAT refunds.

– VAT Identification Number will give a professional face to your business.

Setting Up Business Registration Number:

To set up these Business Registration numbers, simply:

1. Log into your MGR account via a web browser.

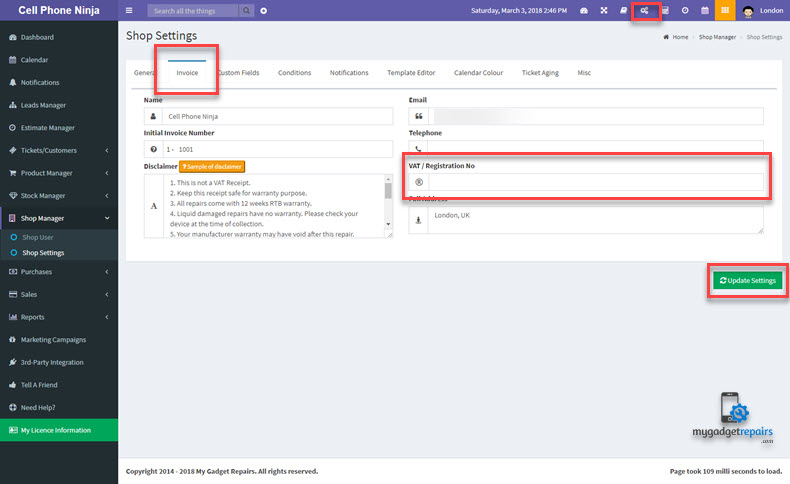

2. Go to Settings by clicking on the gear icon and go to the Invoice Tab.

3. Go to VAT / Registration No field and mention the VAT / REGISTRATION NO or ID.

4. Finally, click on Update Changes button at the bottom.

Now when you issue a receipt or invoice, this registration will display on these invoices.