Sales tax requirements vary by region, so we recommend consulting with a tax professional or an accountant on what may be your best options, plus any applicable laws to your state, country or business. Each business is unique, and there’s no way we can cover millions of possibilities.

Please follow the following steps to enable multiple taxes.

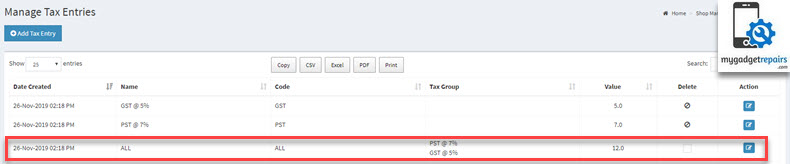

- Go to the “Manage Tax Entries” interface and create taxes you need.

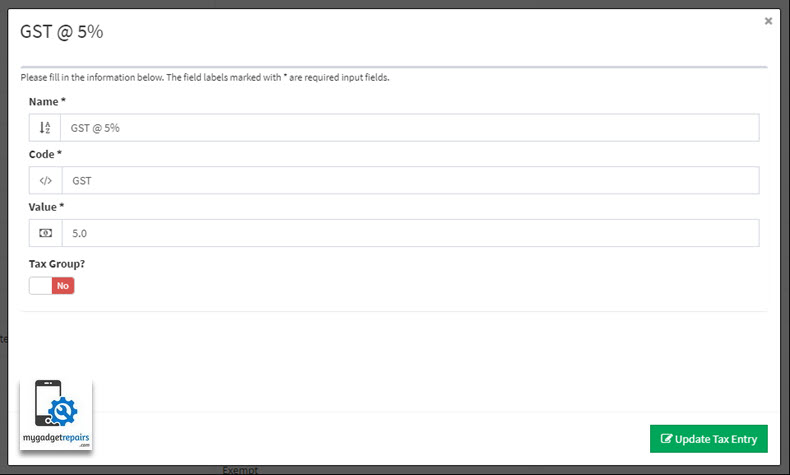

- Create a GST tax first.

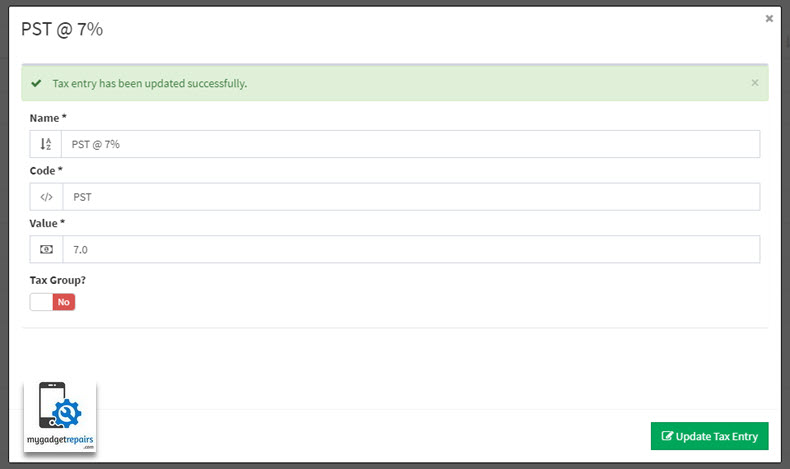

- Create a PST tax next.

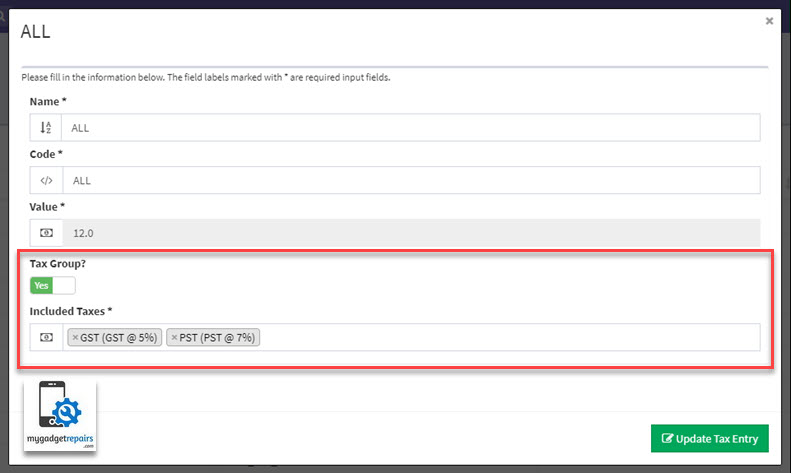

- Now combine both taxes together with the “Tax Group?” option. You will notice that the “Value” option is disabled, the system will automatically calculate this based on your selection in the “Included Taxes” field. Please note that you can add as many taxes as you want.

- You “All” tax will look like the following.

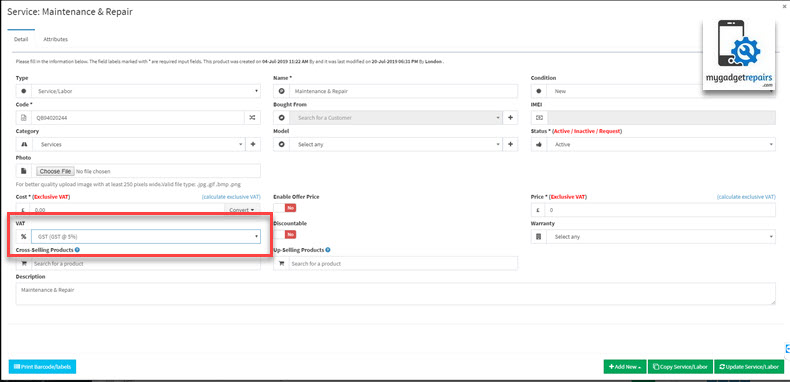

- Next, please go to Inventory and manually assign just GST to the non-physical items like “Labor“.

- Next, please go to Inventory and manually assign just ALL to the physical items, if you have lots of products to update then please either use the “Bulk Product Update” or via CSV file.

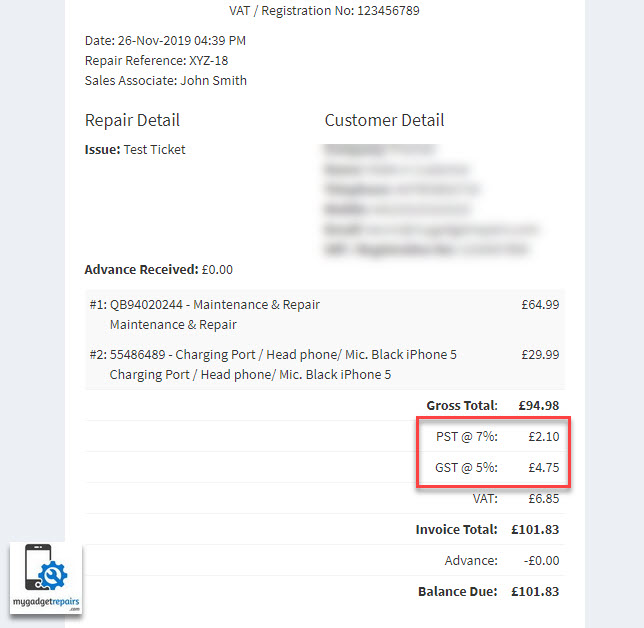

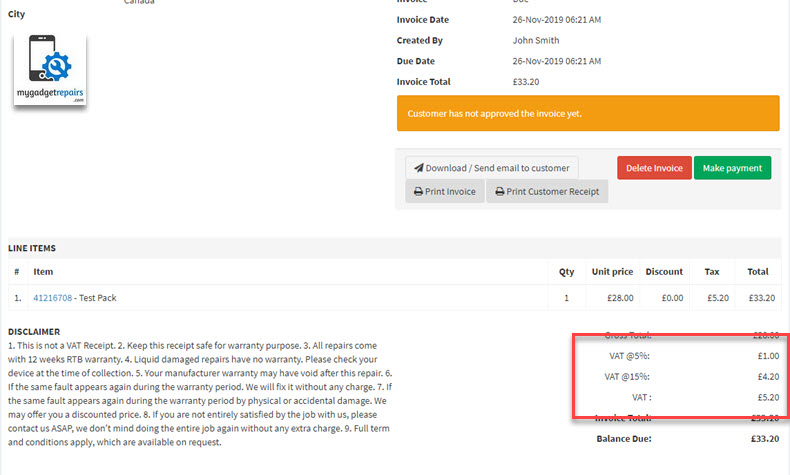

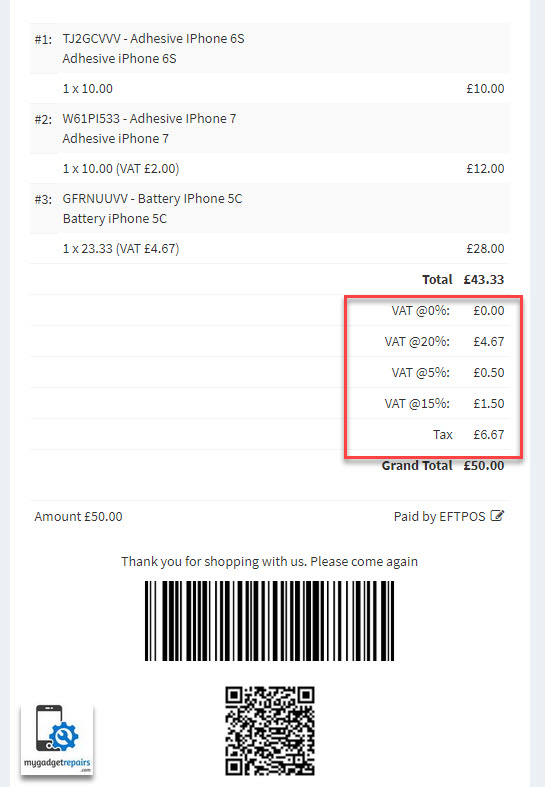

- Now when you generate the invoices or ticket receipts, you’ll be able to see this clearly in the Invoice like the following.

- Ticket receipt.

- Ticket Invoice

- POS Invoice

- Ticket receipt.

- API endpoints will also return the multi-tax information.