Managing Invoices can be a very hectic task. An up-to-date record of invoices is required not only to accurately calculate your revenues but also for filing taxes. In this article, we will discuss how you can manage your invoices in MGR. Let’s get straight to it.

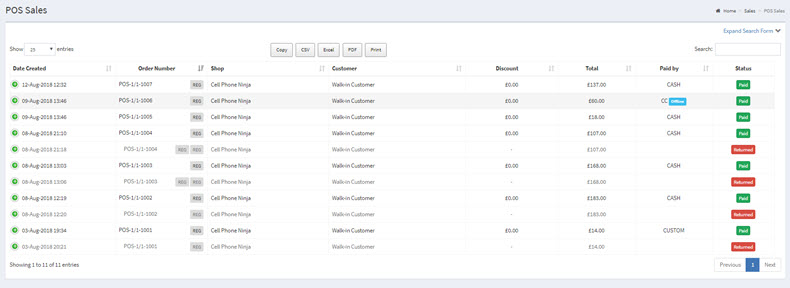

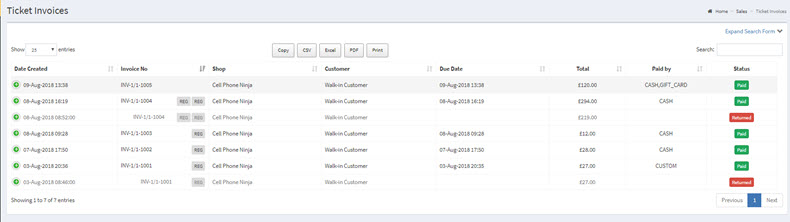

MGR calculates POS and ticket invoices separately. Simply click on “Sales” and select either “POS Sales” or “Ticket Invoices” from the list. You will land on the main listing page of invoices. From here, you can sort invoices or search for specific ones via the Expand Search Form, create a New Invoice, Export Invoices in the form of CSV file, perform various actions on single or multiple invoices and view the status of invoices via graphical representations.

How to delete an invoice?

To delete an invoice, simply click the delete button located within the “Actions” column of the invoice list.

⚠️ Important Note: If the invoice is linked to a refund, the system will not allow deletion until the refund is removed. You must first delete the associated refund using the same process, by clicking the delete button in the “Actions” column of the refund entry.

These safeguards are in place to:

-

Prevent data inconsistencies across financial records

-

Avoid accidental deletion of critical accounting data

-

Ensure transaction integrity in cases involving payments and refunds

Once the refund is successfully deleted, you can proceed with deleting the invoice. Always double-check dependencies such as payments, credit notes, or linked transactions before attempting to delete an invoice to ensure a clean and accurate data trail.

If you require assistance or are unsure about the implications of deletion, we recommend consulting your account administrator, as you may not have the correct rights.

If your invoices are synchronised with third-party accounting platforms such as Xero, QuickBooks, Sage, MYOB, or FreeAgent, please note:

Deleting an invoice in the system does not automatically delete it from your accounting software. You will need to log in to the respective platform and manually delete the invoice to ensure data consistency across systems.

For compliance, security, and traceability reasons, the system does not delete invoices from external accounting platforms. This is intentional and designed to:

-

Respect audit trails: Many accounting systems maintain permanent records for compliance and legal purposes.

-

Prevent unauthorised data loss: Direct deletion can violate financial controls or company policies.

-

Maintain user accountability: Manual deletion ensures the user has reviewed and confirmed the action within the accounting context.

-

Avoid sync mismatches: Automated deletions could cause data corruption or discrepancies if other records (e.g., payments, reports, or journal entries) are already linked to the invoice.

Always ensure you delete the invoice in both systems if necessary, and consult your accountant or bookkeeper before making permanent changes to financial records. Failing to do so may result in mismatched records between MGR and your accounting software, which could affect your financial reporting and reconciliation.